This post describes an that is a result of the massive job loss. Again, we'll look at the Californian state since it's the biggest.

With a demand for cheaper goods there are a number of sectors that are consistently losing jobs to cheaper off-shore manufacturers. India and most notably China are consuming American jobs. Now, obviously globalization is not the only issue at hand. The collapse of the housing market is an indicator there are more problems than just Mr. Chan stealing your job.

Firstly, China has our jobs because we let them and we demand cheap goods. the pressure to create the cheapest good (competitive market place) means we can't afford the most expensive labor which is American. That means you get a cheap crib and Chan makes it, not Smith. Simple economics.

The other problem of course is the collapsed housing market which is a result of a) lost jobs, b) financial meltdown as a result of greedy wall street execs.

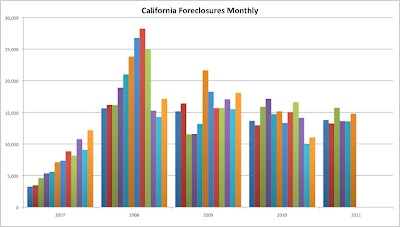

Look at the foreclosure rates in the past few years.

![]()

All over the place, but most notable some huge consistent increases month over month. Is there any end in sight? When you think you're coming out of the abyss you can view another knock in improvement. So what's the solution?

Foreclosures are the last straw for many. They can't save the home, the bank takes it back.

Jobs is the obvious answer.

After jobs, some breathing room for those with predatory rates.

After that, jobs.

Then add some jobs.

Then stop wasting money on military and govt waste.

Then jobs.

Which of course means something has to change, because we CANNOT keep doing things the way we used to. That goes for the finance system AND our buying behavior.

Again, tons of thanks to San Diego Bankruptcy Lawyers Cecilia Chen for letting us use their stats.

With a demand for cheaper goods there are a number of sectors that are consistently losing jobs to cheaper off-shore manufacturers. India and most notably China are consuming American jobs. Now, obviously globalization is not the only issue at hand. The collapse of the housing market is an indicator there are more problems than just Mr. Chan stealing your job.

Firstly, China has our jobs because we let them and we demand cheap goods. the pressure to create the cheapest good (competitive market place) means we can't afford the most expensive labor which is American. That means you get a cheap crib and Chan makes it, not Smith. Simple economics.

The other problem of course is the collapsed housing market which is a result of a) lost jobs, b) financial meltdown as a result of greedy wall street execs.

Look at the foreclosure rates in the past few years.

All over the place, but most notable some huge consistent increases month over month. Is there any end in sight? When you think you're coming out of the abyss you can view another knock in improvement. So what's the solution?

Foreclosures are the last straw for many. They can't save the home, the bank takes it back.

Jobs is the obvious answer.

After jobs, some breathing room for those with predatory rates.

After that, jobs.

Then add some jobs.

Then stop wasting money on military and govt waste.

Then jobs.

Which of course means something has to change, because we CANNOT keep doing things the way we used to. That goes for the finance system AND our buying behavior.

Again, tons of thanks to San Diego Bankruptcy Lawyers Cecilia Chen for letting us use their stats.